This blog is not legal advice.

Acquisitions and divestitures are constantly evaluated on both a short and long-term basis; seeking geologically rich plays, where technical expertise can be leveraged for greater recovery margins and reducing costs. Your asset strategy is designed and constantly re-evaluated to maximize core competencies and increase stakeholder value. To verify the condition and value of the assets, you must perform due diligence on the property and equipment you are purchasing. Without proper and ACCURATE due diligence, you increase the risk of post-acquisition disappointment for you and your stakeholders with unbudgeted liabilities and the diversion of resources. Your team needs to QUICKLY get a wholesale picture of thousands of land records and well files so you can assess a deal’s potential, and move fast to secure acreage.

What is Due Diligence?

Due diligence is the process of a prospective buyer investigating the seller and the assets before the purchase, just like taking a test-driven car to your favorite mechanic. You need to do more than kick the tires, you want to know what is going on under the hood. In the context of oil and gas acquisitions, due diligence examines geological data, financial records, well tests, legal records, and other information concerning the value and conditions of the assets being acquired. The due diligence process can take several months, although an AI-based oil and gas contract analytics solution, such as the ThoughtTrace Document Understanding Platform, can dramatically reduce the time and cost involved.

Why Is It Needed?

Due diligence reduces the risks inherent in acquiring oil and gas properties and relies solely on the buyer to know what they are looking for and where. Put simply, effective due diligence makes sure that there are no surprises or assumptions and increases the odds of turning the property acquired into a profitable asset and stakeholder value. Even after a deal closes, you’ll need to reconcile and incorporate the critical lease and other asset data your land and operations team needs.

Save millions on your next deal: Conduct the fastest and most accurate oil and gas due diligence at a fraction of the cost.

What Steps are Needed for Due Diligence?

While every due diligence process is unique, there are common steps you need to take to properly evaluate the asset to be acquired.

-

Before Executing the Purchase Agreement

A surprisingly large amount of due diligence in the oil and gas industry can take place before the purchase agreement is executed – even before the first meeting with the current asset holder. This initial due diligence can involve any or all of the following activities:

-

Review the sales brochure or bid package for the property, often with the help of a broker or agent

-

Review the public production history, regulatory filings and review key documents to estimate the size of reserves, capital expenditure requirements, rate of return, and other key metrics to determine the profitability of the transaction

-

Research any pertinent information about the seller, including news articles, press releases, SEC filings, earnings reports, and litigation history

If this initial investigation proves positive without uncovering any major issues, you can then proceed to sign a purchase agreement – and progress to more detailed pre-closing due diligence.

-

Engineering Due Diligence

Comprehensive pre-closing due diligence is typically divided between functional groups within the organization. The first such group is engineering; petroleum engineers examine the economic viability, estimated reserves of the assets, and spend time forecasting future production potential to determine a suitable valuation for the basis of a purchase price. Production models and rigorously evaluated development options help asset planners, engineers, and economists make the right decisions. Proper due diligence in this area is the foundation of the remaining research, as it sets the bar for value. Like scratches in the paint, all the remaining due diligence research is designed to pinpoint and highlight the gaps and defects.

-

Land Due Diligence

Land due diligence is often the most time-consuming activity of the acquisition process due to the unstructured nature of the analysis in documents. These tangible and intangible assets, particularly any instrument relating to the selling company’s interest in real property, improvements, leases, options, deeds, and assignments must be reviewed.

Your landmen prioritize those assets by value, the greatest percentage of the purchase price, and/or location, simply due to certain areas being core to their asset strategy. Much of this due diligence requires painstaking sorting through all available records, although the process can be expedited via the use of online resources. Limited resources and an expiring window of time often leads to skipping the review of less valued assets completely.

Clearly communicated priority alignment will help everyone involved focus their efforts on the most valuable assets according to your goals. Among other things, due diligence requires confirmation that no encumbrances are affecting the assets and have been maintained in accordance with all contractual requirements with the proper parties. Gaps and clouds are surfaced for defect analysis by the acquiring legal team, as each one has the potential to single-handedly and/or cumulatively destroy your deal.

-

Legal Due Diligence

Legal due diligence is an essential part of the process in parallel with land due diligence. In addition to reviewing the due diligence defects of the land staff, your legal team needs to do a legal contract review, any current or pending lawsuits, claims, or demands, including government agency or administrative proceedings and tax deficiencies, pending or threatened against the seller’s company or assets. Other liabilities to investigate are debts, all warranties, guarantees, and other obligations given or incurred by the selling company. A divide and conquer mentality must be used here too, as research and review of the assets are not the only goals your legal team must handle. The drafting, negotiation, and finalization of all transaction documents are also critical and time-intensive goals for this team making organization and collaboration keys to success.

-

Financial Due Diligence

Your accounting staff makes up a key component of your company’s due diligence team. The team needs to investigate all accounting records for content and accuracy. Any discrepancies discovered should be brought to your attention. It’s also important to verify that the seller is current on all tax and royalty payments. Be prepared to perform an extensive review of all available financial statements for the preceding year; any interim statements for subsequent periods; and any pro-forma financial statements or projections. Plus ask for copies of any management reports prepared by the company’s accountants or auditors, you will want to review those too. Request any insurance policies held by the selling company related to its assets or business and the name of their broker or agent. Proper due diligence will also find any persons given tax or other powers of attorney by the company and for what those powers were given. Closing as many gaps here as possible before purchase will improve your chances of a smooth transition.

-

Environmental Due Diligence

The assets you acquire must conform to all applicable environmental laws and regulations, which can be determined by your environmental due diligence team. Special attention should be paid to any permitting or reporting issues that might be attempting to hide environmental problems. Physical inspection is no short-cut, historical inspection is where the skeletons are. Detailed examination of development plans, permit applications, subsequent inspection reports, and as-built designs will give you a looking glass into the past, current status, and the future for upcoming projects.

-

Marketing Due Diligence

Members of your marketing team should work with your accounting staff to identify any potential liabilities with the seller’s existing marketing, storage, processing, and transportation contracts, especially those with terms greater than a few months. Marketing staff can also help evaluate the gas imbalance position of the seller. While the midstream sector experiences imbalances regularly in pipelines, the upstream imbalances usually happen at the wellhead. With data elements to consider siloed in the production, land/division order, marketing, and revenue departments, a centralized solution is pivotal to understand an operator’s balancing requirements and obligations prior to closing on the acquisition.

-

Antitrust Due Diligence

For larger acquisitions, your legal staff must determine if the transaction is subject to filing under the Hart Scott Rodino Antitrust Act. If so, all necessary paperwork must be completed and filed with the Federal Trade Commission and Department of Justice. Competitively sensitive information (CSI) cannot be shared among competitors to avoid collusion or coordinated business behavior that lessens competition between or among them. Whether you decide to (1) share this with outside counsel or other third parties assisting in the evaluation or (2) create a clean team consisting of a small number of individuals to evaluate the CSI; reducing the risk of violation must be taken seriously. If an anti-trust enforcement body believes there has been an improper exchange, it will likely open a separate, costly and time-consuming, investigation.

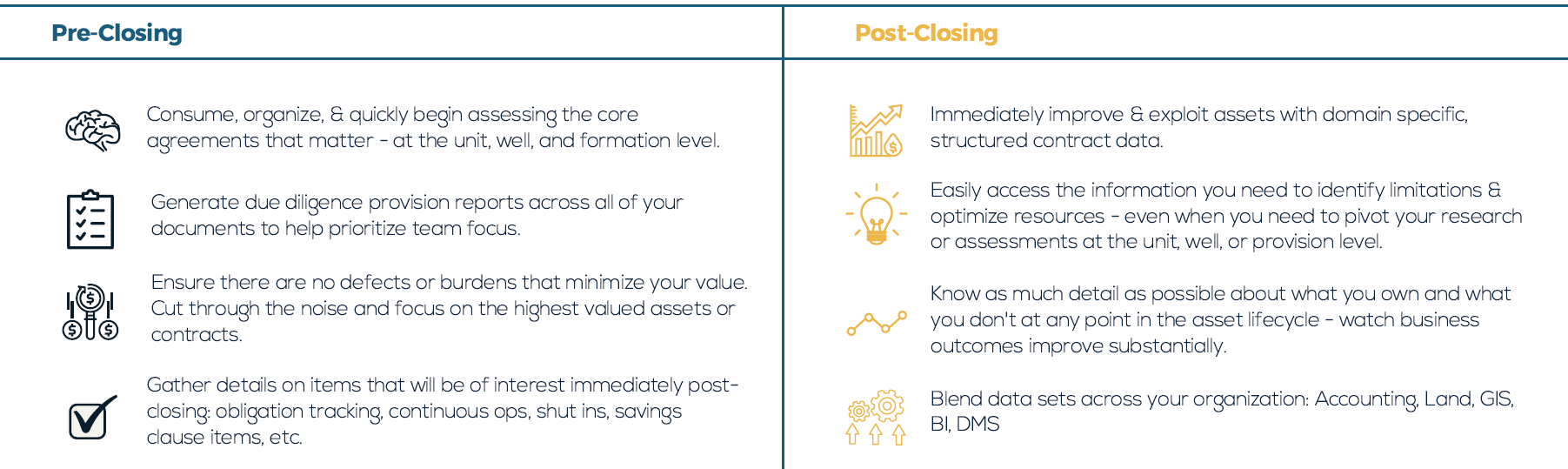

Post-Closing Diligence

If the due diligence does not uncover any major issues, the closing will come. Due diligence in oil and gas, however, continues after the closing and celebration dinner. Your acquisition staff need to file all appropriate paperwork, ensure that any ongoing operations are properly transitioned, and confirm proper compliance with all legal obligations. Before your team can then turn its attention to your next acquisition, you must reconcile between the Pre-Closing transactional due diligence and Ongoing Enterprise due diligence. These are two very different activities with a certain set of similar considerations. Post-Closing due diligence is the overlay of ongoing enterprise activity with specific issues relevant to the transaction. All forms of efficiently, effectively executed due diligence should be customized to your organizations needs and goals in a dynamic process subject to change indefinitely.

Document Intelligence to Supercharge the Oil and Gas Due Diligence Process

Request a Demo | Learn more about the ThoughtTrace Solution for Oil and Gas